Globalization of capital markets

1970s: Dismantling of restrictions and controls of capital transfers

⇒ free flow of capital (formerly: subject to authorization by individual states)

⇒ Anybody can invest assets where they yield the highest profits

No "commodity" is as mobile as capital. Great sums are sent round the world in seconds.

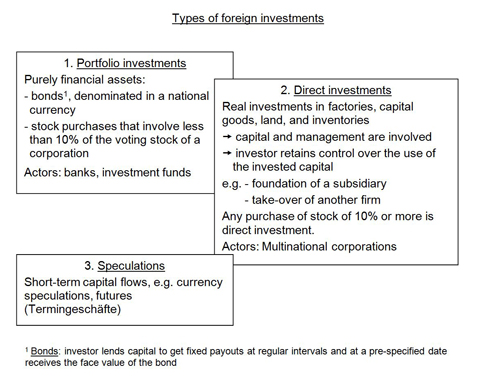

Motives for international portfolio investments

- Basic motive: to earn higher returns abroad

- But: higher risks, e.g. currency fluctuations, possibly: less reliable legal system etc.

Motives for direct foreign investments

Also: higher returns, possibly due to:

- higher growth rates abroad

- more favourable tax treatment

- lower wages

- better infrastructure

Additional reasons:

- Horizontal integration : Unique production knowledge/technology, over which the corporation wants to retain direct control ⇒ direct investment instead of giving away licenses

- Vertical integration : Corporation wants to obtain control of a needed raw material ⇒ security of supply, costs

- Avoidance of tariffs and other import restrictions

- Subsidies granted by governments to encourage foreign direct investment

- New market entrance

- Purchasing of foreign firm to avoid future competition

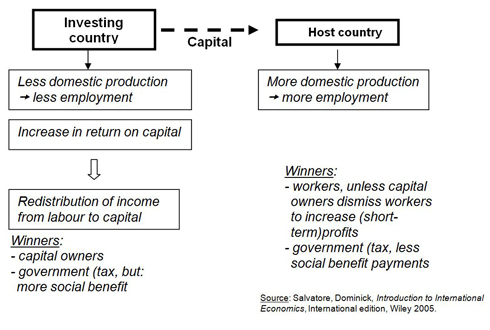

Effects of international capital flow s

⇒ greater efficiency in the use of capital ⇒ higher world output and welfare

Effects on investing country and host country :

Capital flows from the nation of lower returns to the nation of higher returns until returns have been equalized in the two countries

Dokument herunterladen [.doc][404 KB]